I have to go to attend one marriage function today evening, the blog will be updated late night.

शहादत का सेहरा

बाँधे, मृत्यु से विवाह

रचाता हूँ ||

जन्मभूमि की रक्षा खातिर, अपनी भेंट चढ़ाता हूँ|| मैं तेरा बेटा बनकर आया,इस दुनिया मे मां लेकिन.भारत मां का बेटा बनकर, इस दुनिया से जाता हूँ|| मां देख तिरंगा मेरे तन पर, कितना सुंदर खिलता है.ऐसा कफ़न मेरी मां बस, किस्मतवालो को मिलता है|| देकर समर्पण मातृभूमि को, गर्व से मैं इठलाता हूँ.मैं तेरा बेटा बनकर आया,इस दुनिया मे मां लेकिन भारत मां का बेटा बनकर, इस दुनिया से जाता हूँ|| पठानकोट में शहीद हुए माँ भारती के वीर जवानो को शत् शत् नमन |

|||||||||||

Levels to watch

Nifty Future -

intraday resistance are : 7860, 7875, 7890, 7905, 7920, 7935

Nifty Futue - intraday support are : 7785, 7770, 7755, 7740, 7725, 7710

Bank Nifty future - intraday resistance are : 16685, 16735, 16775, 16815, 16860, 16905, 16945

Bank Nifty future - intraday supports are : 16585, 16545, 16495, 16455, 16415, 16365, 16320 |

|||||||||||

For Positional

traders : For those who trade like Investors

|

|||||||||||

Weekly SAR Levels

|

|||||||||||

Security

|

Hige

|

Low

|

Close

|

MySAR

|

5-EMA

|

High-EMA

|

Low-EMA

|

||||

Nifty

(Future)

|

7947.75

|

7792.60

|

7809.80

|

7777.89

|

7856.25

|

7945.52

|

7773.92

|

||||

BankNifty

(Future)

|

17000.00

|

16603.00

|

16629.45

|

16669.16

|

16821.08

|

17081.72

|

16636.22

|

||||

Weekly Pivot Levels

|

|||||||||||

Security

|

W-S3

|

W-S2

|

W-S1

|

W-Pivot

|

W-R1

|

W-R2

|

W-R3

|

||||

Nifty

(Future)

|

7539.75

|

7694.90

|

7752.35

|

7850.05

|

7907.50

|

8005.20

|

8160.35

|

||||

BankNifty

(Future)

|

15950.15

|

16347.15

|

16488.30

|

16744.15

|

16885.30

|

17141.15

|

17538.15

|

||||

Daily MySAR Levels For Future

Segment :

Daily MySAR Levels For Cash

Segment :

|

|||||||||||

For other Nifty 50 (future) scrips click link :

Do not enter into a trade without referring

past data. It will save your trade from catching the running train.

If

the price of the scrip ran up or down too much during last few days, please

please do not take fresh entry either of short or long otherwise it will be

considered as catching of running train and in such cases price in near

future may move against expectations resulting into losses. Better wait for

breach of MySAR_A level for fresh trade......

|

|||||||||||

Patience pays...........

Presently holding Position :

-------------------------------------------------------------------------------------------------------------------

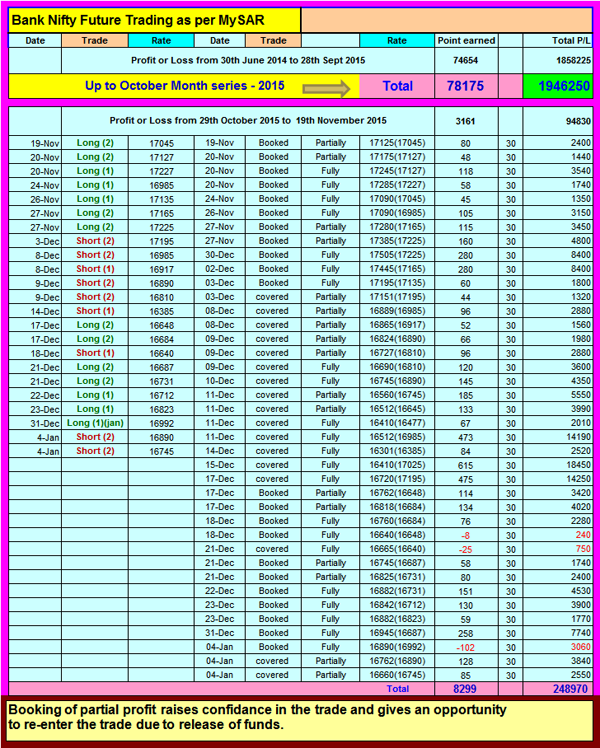

If anyone want to have complete trade list of positional trades from 30th June, 2014,

please mail us at gauresh59@gmail.com

-------------------------------------------------------------------------------------------------------------------

Trades

triggered on 31st December

1. BNF (4L) short at 16900…………………covered at 16782 (+ 472

points)

2. NF (4L) short at 7875……………………..covered

at 7840 (+ 140 points)

3. BNF STBT at16885…………….carried

4. NF STBT at 7885………………carried

1. LT (F) short at 1277…………………………covered

at 1271 (1800 profit)

gauresh59

(04-01-2016 09:17:19): LT resistance at 1291................ 1297..........

1305............... support at 1277……………1271……………..

gauresh59

(04-01-2016 11:21:30): LT shorts covered at 1271

2. ACC (F) short at 1371………………..covered

at 1354 (6375 profit)

gauresh59

(04-01-2016 09:17:45): acc resistance at 1381............support at

1371............. 1367............. 1361............

gauresh59

(04-01-2016 11:21:15): acc shorts covered at 1354

3. AxisBank (F) short at

445…………………covered at 441 (4000 profit)

gauresh59

(04-01-2016 09:17:58): axisbank resistance at 451..........weak below

445........... 443........... 441..........

gauresh59

(04-01-2016 12:09:18): axisbankkkkkkkk…………alerted when reached 441……….

4. JSWsteel (F) long at

1031……………….booked at 1045 (8400 profit)

gauresh59

(04-01-2016 09:18:30): jswsteel resistance at 1031........... 1034.............

1037 .............. support at 1020..........1015................

gauresh59

(04-01-2016 09:37:50): jswsteelllllllllllllllllllllll

gauresh59 (04-01-2016 09:38:16): 1045 is daily highema in jswsteel .......go on trailing sl or book out .......

gauresh59

(04-01-2016 09:38:57): jswteel booked out ..........

5. KotakBank (F) short at

720…………………covered at 711 (6300 profit)

gauresh59

(04-01-2016 09:19:02): kotak bank open high equal at 725...........low at

721......weak below 720..............715..............strong above

725............729.............

gauresh59

(04-01-2016 11:20:15): kotak....near the next support .......711.......covered

.....

6. Maruti (F) long at 4652 ………………booked

at 4642 (1250 loss)

gauresh59

(04-01-2016 09:19:47): maruti weak below 4624................

4614.................4604 .......... strong above

4652............4658...........4664............4674...........

sl hit ……..

7. Maruti (F) short at 4624…………………………….covered

at 4604 (2500 profit)

gauresh59

(04-01-2016 09:19:47): maruti weak below 4624................

4614.................4604 .......... strong above

4652............4658...........4664............4674..........

gauresh59

(04-01-2016 12:01:45): marutiiiiiiiiiiiiiiii.........

8. RelCap (F) short at 464……………………covered

at 457 (10500 profit)

gauresh59

(04-01-2016 09:20:40): relcap support at 464...........

461..............457.............. resistance at

471............474............477..............481...........

gauresh59 (04-01-2016 10:17:24): relcapppppp……….

9. RELinfra (F) short at

594……………………covered at 587 (9100 profit)

gauresh59

(04-01-2016 09:21:34): relinfra support near 594............. 591............

587........584 ............... resistance at

601..............604.............607................

gauresh59 (04-01-2016 010:31:27): relinfraaaaaa…………

10. M&M (F) short at

1251……………………….covered at 1245 (2400 profit)

gauresh59

(04-01-2016 09:22:18): M&M resistance at

1267...............1274................support at

1251...........1247...............1243........

gauresh59

(04-01-2016 11:22:17): M&M.......near the support of 1247.......go on

trailing sl at entry

gauresh59 (04-01-2016 11:54:24): M&Mmmmmm.......

Three Thumb

Rules for intraday trading :

(1) Always trade only at the levels given.

(2) Keep booking profits without missing a winning opportunity.

(3) And once in profit, trail stop loss to the entry level to protect

the capital funds.

Wish you all happy and profitable trading ahead……

==============================================================

Updated upto 4th January

Following are the trades triggerd as per MySAR levels for Nifty and BankNifty. Calculation of only one lot has been taken into consideration. As per the technique, if Two or more lots are traded and partial profit is booked

in between considering daily as well as weekly pivots and ema numbers,

and go on riding the trend as the levels, then overall profit would

have remained fantastic….

|

|||||||||||

|

|

|||||||||||