Watch

intra-day performance

|

|||||||

Today’s

Trading /calls (breakout system) 23rd April

Nifty Future Buy above 5840...for 5855/5870/5885/5900/5915...sl 5815

Nifty Future Sell below 5810...for 5795/5780/5765/5750/5735....sl 5825

Bank Nifty future Buy above 12570...for 12605/12655/12685/12710/12760/12785/12820/12860...sl 12490

Bank Nifty future Sell below 12490...for 12455/12430/12395/12360/12325/12290/12260/12225....sl 12570

|

|||||||

we have added JSWSteel and McDowell scrips

in Excel Spreadsheet.

For

Positional traders : For those who trade like Investors

ICICIBank in cash Buy @aound 1137 with sl of 1125 for 1175 and 1184TataSteel in cash Buy with support of 296 and 293 for 319 and 323

BankIndia in cash Buy with sl of 327 for 359 and 367

Biocon in cash Buy with sl of 278 for 303 and 310

Sesagoa in cash Buy with support of 143 for 159 and 163

|

|||||||

Daily Levels

|

|||||||

Security

|

High

|

Low

|

Close

|

MySAR

|

5-EMA

|

High

EMA

|

Low

EMA

|

Nifty

(F)

|

5843.10

|

5791.00

|

5832.85

|

5641.15

|

5734.95

|

5755.22

|

5670.70

|

BankNifty(F)

|

12651.75

|

12299.00

|

12567.85

|

11689.40

|

12103.89

|

12176.41

|

11839.67

|

Weekly Levels

|

|||||||

Security

|

WHigh

|

WLow

|

WClose

|

W_MySAR

|

W5-EMA

|

WHigh

EMA

|

WLow

EMA

|

Nifty

(F)

|

5843.10

|

5791.00

|

5832.85

|

5649.55

|

5739.94

|

5798.41

|

5637.84

|

BankNifty

(F)

|

12651.75

|

12299.00

|

12567.85

|

11548.59

|

12002.82

|

12152.76

|

11576.84

|

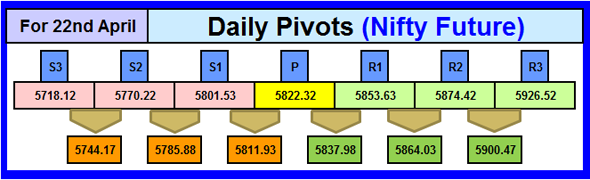

Weekly Pivot Levels

|

|||||||

Security

|

W-S3

|

W-S2

|

W-S1

|

W-Pivot

|

W-R1

|

W-R2

|

W-R3

|

Nifty

(Future)

|

5718.12

|

5770.22

|

5801.53

|

5822.32

|

5853.63

|

5874.42

|

5926.52

|

BankNifty

(Future)

|

11800.70

|

12153.45

|

12360.65

|

12506.20

|

12713.40

|

12858.95

|

13211.70

|

Daily MySAR Levels For Future

Segment :

Daily MySAR Levels For Cash

Segment :

=======================================================================

Don't miss to...

Watch how much positional traders benefitted

Performance

of MySAR for various scrips >>>>

click

(this week file has been updated upto 28th March ) |

|||||||

For

other Nifty 50 (future) scrips

click link :

Do not enter into a trade without referring

past data. It will save your trade from catching the running train.

If

the price of the scrip ran up or down too much during last few days, please

please do not take fresh entry either of short or long otherwise it will be

considered as catching of running train and in such cases price in near

future may move against expectations resulting into losses. Better wait for

breach of MySAR_A level for fresh trade......

|

|||||||

Patience

pays...........

Presently Holding Position :

For Nifty (F) : Long 5621, 5833 For BankNifty (F) : Long 12555

Trades

triggered on 22nd April

1. ACC (F) long taken at 1222…………..booked at 1229 (1750 profit)

2. HeroMotors (F) long taken at 1510…..booked at 1523 (1625 profit)

3. JSWSteel (F) long taken at 725.50……booked at 730.50 (2500 profit)

4. Titan (F) long taken at 266…………..booked at 268 (2000 profit)

5. M&M (F) short taken at 889……covered at 885 (2000 profit)

6. HDFC (F) long taken at 832.50……booked at 827.50 (2500 loss)

7. PNB (F) long taken at 774.50…..booked at 785 (5250 profit)

8. SBI (F) long taken at 2330……booked at 2321 (1125 loss)

9. M&M (F) long taken at 892…..booked at 888 (2000 loss)

10. ACC (F) short taken at 1210……covered at 1212.50 (625 loss)

11. RELInfra (F) long taken at 374.50…..booked at 379 (2250 profit)

12. LT (F) long taken at 1516 …..booked at 1523 (1750 profit)

13. ICICIBank (F) long takn at 1135.50…..booked at 1142

(1625 profit)

14. LT (F) long taken at 1525……booked at 1534 (2250 profit)

15. JSWSteel (F) long taken at 727…..to carry

16. M&M (F) long taken at 893….to carry

17. PNB (F) long taken at 886….to carry

18. BNF positional long 11680….booked at 12480 (+ 800 points)

19. BNF short taken at 12449 (2L) ……covered 12490 (- 82 points)

20. BNF long taken at 12520…..booked at 12480 (- 40 points)

21. BNF short taken at 12470…..covered at 12420 (+ 50 points)

22. BNF long taken at 12555 (2L)……booked at avp 12615 (+ 120

points)

23. NF positional long 5697…….booked at 5818 (+ 121 points)

24. NF long taken at 5833…..carried

------------------------------------------------------------

Three Thumb Rules :

(1) Always trade only at the

levels given.

(2) Keep booking profits without

missing a winning opportunity.

(3) And once in profit, trail stop

loss to the entry level to protect the capital funds.

Wish you all happy and profitable trading ahead……

==============================================================

|

|||||||

Have you incurred loss in Stock Market...?

Are you disssatified with the earnings in the Stock Market...?

Are you confused ...?

Following Pictures will clarify our ideology :

For more information click http://mytradingtechnique-mysar.blogspot.in/2013/03/have-you-incurred-loss-in-stock-market.html <><><><><><><><><><><><><><><><><><><><><><><><><>< |

|||||||

MySAR for 23rd April

Subscribe to:

Comments (Atom)