Today’s

Trading potentialies (breakout system) for 17th April

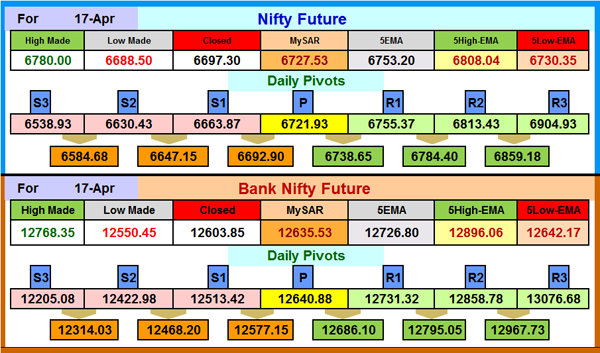

Nifty

Future above 6731 ...may reach 6745/6760/6775/6790/6805/6820

Nifty

Future below 6685...may reah 6670/6655/6640/6625/6610/6595

Bank

Nifty future above 12665 ...may reach 12695/12730/12775/12815/12855/12895/12935

Bank

Nifty future below 12570 ...may reach 12530/12490/12455/12420/12380/12340/12305

|

|||||||

For

Positional traders : For those who trade like Investors

SBI in cash can be bought @ around 1944 with sl of 1930 ...may reach 1988 and 1997 HCLtech in cash can be bought with support of 1387 ...may reach 1433 and 1445 LT in cash can be bought with support of 1241 and 1227 ...may reach 1289 and 1297 TechM in cash can be bought with sl of 1724 ....may reach 1767 and 1779 ICICIBank in cash can be bought with sl of 1203 ...may reach 1237 and 1245 KotakBank in cash can be bought with support of 774 ....may reach 799 and 808 PNB in cash can be bought with support of 751 and 743 ...may reach 779 and 785 |

|||||||

--------------------------------------------------------------------------------------------------------------------------

|

|||||||

Weekly Pivot Levels

|

|||||||

Security

|

W-S3

|

W-S2

|

W-S1

|

W-Pivot

|

W-R1

|

W-R2

|

W-R3

|

Nifty (Future)

|

6458.93

|

6598.43

|

6647.87

|

6737.93

|

6787.37

|

6877.43

|

7016.93

|

BankNifty (Future)

|

11952.33

|

12321.88

|

12462.87

|

12691.43

|

12832.42

|

13060.98

|

13430.53

|

Daily

MySAR Levels For Future Segment :

Daily

MySAR Levels For Cash Segment :

-------------------------------------------------------------------------------------------------------------------

Don't miss to watch: updated upto 11th April 2014

To watch the performance of MySAR : |

|||||||

For other Nifty 50 (future)

scrips click link :

Do not

enter into a trade without referring past data. It will save your trade from

catching the running train.

If the price of the scrip ran

up or down too much during last few days, please please do not take fresh

entry either of short or long otherwise it will be considered as catching

of running train and in such cases price in near future may move

against expectations resulting into losses. Better wait for breach of MySAR_A

level for fresh trade......

|

|||||||

Patience pays...........

Presently holding Position :

NF Shrot (6285) (2+ 2L @6180) : covered at 6270, 6155, 6100,6045

(fully covered) (360 pointed booked) rollover done for Feb. series

BNF long (11010) (2L+2L10710) : covered at 10985, 10610, 10360, 10180

(fully covered)(1305 points booked) rollover done for Feb. series

NF Shrot Feb. (6112 + @ 6120) : covered at 6060, 6050 (fully covered)

(Booked 122 points)

BNF long Feb. (10248 + @ 10300) : covered at 10155, 10275 (fully covered)

(Booked 118 points)

NF Long Feb. (6050) : bookd at 6105 (fully booked)

(Booked 55 points)

BNF long Feb. (10250) : booked at 10375 (Fully booked)

(Booked 125 points)

NF Shrot Feb. (6045) : covered at 6005 (fully covered & reversed)

(Booked 40 points)

BNF Short Feb. (10230) : covered at 10135 (covered & reveresed)

(Booked 95 points)

NF Long Feb. (6058+@ 6099+@ 6135) : Booked at 6095,6145,6215,6240

(Fully booked) (Booked 345 points)

BNF long Feb. (10225+@ 10360+@ 10510) : Booked at 10305, 10590, 10750, 1074 (fully booked) (Booked 1065 points)

Positional longs in NF (March) at 6271(2L) + 6266 + 6555 (Fully booked & rollovered)

(booked at 6325, 6420, 6625, 6651) (+ 658 points)

Squared

off fully today at 6470 due to large intraday correction, but later on

taken again long at 6495 positionally according we have changed the

price from 6241 to 6266.

Positonal longs in BNF (March) at 10773 (2L)+ 10661 + 11165 + 12251(Fully booked & rollovered)

(booked at 10920, 11310, 12100, 12565, 12651 (+ 3923 points)

For March series both NF & BNF position booked and take longs in April Series

Positional longs in NF (April) at 6675 + 6775, 6753 (fully booked) only

(booked at 6825, 6751 (+ 124 points)

Positonal longs in BNF (April) at 12705+12651+12570+12675+12675 (fully booked)

(booked at 12760, 12695, 12960, 13000 (+ 790 points)

Positonal longs in NF (April) at 6753 (Booked)

(Booked at 6735 (- 18 points)

Positonal shorts in NF at 6733 (1L holding)

(Booked at 6690 (+ 43 points)

Positonal shorts in BNF (April) at 12661 + 12645 (2L holding)

(Booked at 12575 (86 points)

-----------------------------------------------------------

Trades triggered on 16th April

1. JSWSteel (F) shorted long at 1024………….booked

at 1028 (2000 profit)

2.

TCS (F) shorted at 2241……………………….covered at 2231 (1250 profit)

3.

M&M (F) long at 991……………………………booked at 987 (1000 loss)

4.

PNB (F) long at 769…………………………….booked at 774 (2500 profit)

5.

SBI (F) long at 1975…………………………….booked at 1995 (2500 profit)

6.

TechM (F) shorted at 1764…………………….covered at 1754 (2500 profit)

7.

TechM (F) shorted at 1751…………………….covered at 1745 (1500 profit)

8.

HCLtech (F) shorted at 1418………………….covered at 1411 (1750 profit)

9.

HCLtech (F) long at 1422………………………booked at 1432 (2500 profit)

10.

TechM (F) shorted at 1764……………………covered at 1765 (1250 loss)

10.

TCS (F) shorted at 2231………..……………covered at 2222 (1125 profit)

11.

TCS (F) shorted at 2219……………………..covered at 2211 (1000 profit)

12.

PNB (F) long at 779…………………………..booked at 784 (2500 profit)

13.

ACC (F) shorted at 1364……………………..covered at 1354 (2500 profit)

14.

ACC (F) long at 1375………………………….booked at 1368 (1750 loss)

14.

JSWSteel (F) shorted at 1019………………covered at 1005 (7000 profit)

15.

RELinfra (F) shorted at 519…………………covered at 511 (8000 profit)

16.

LT (F) shorted at 1287………………………..covered at 1281 (3000 profit)

17.

AxisBank (F) long at 1452…………………..booked at 1450 (2000 profit)

18.

BNF long at 12725………………….............booked at 12762 (+ 37 points)

19.

BNF shorted (4L) at avp 12677…………..covered at 12611 (+ 264 points)

20.

BNF shorted at 12609……………….carried

21.

NF shorted at 6759…………………………covered at 6720 (+ 39 points)

22.

NF shorted at 6733…………………………covered at 6690 (+ 43 points)

23.

NF shorted at 6715…………………..carried

Following table clarifies today's triggerred trades

------------------------------------------------------------------

Three Thumb Rules :

(1) Always trade only at the

levels given.

(2) Keep booking profits without

missing a winning opportunity.

(3) And once in profit, trail stop

loss to the entry level to protect the capital funds.

Wish you all happy and profitable trading ahead……

==============================================================

|

|||||||

Have you

incurred loss in Stock Market...?

Are you

disssatified with the earnings in the Stock Market...

Here is the solution

For more information

Many

Many thanks for Inspiration.....Motivation ....

|

|||||||

MySAR for 17th April

Subscribe to:

Comments (Atom)