Levels to watch

Nifty Future - intraday resistance are : 7855, 7870, 7885, 7905, 7920, 7935 Nifty Futue - intraday support are : 7820, 7805, 7790, 7775, 7760, 7745

Bank Nifty future - intraday

Bank Nifty future - intraday supports are : 16685, 16725, 16770, 16815, 16860, 16905, 16945 |

|||||||||||

For Positional traders : For those who trade like Investors

|

|||||||||||

Weekly SAR Levels

|

|||||||||||

Security

|

Hige

|

Low

|

Close

|

MySAR

|

5-EMA

|

High-EMA

|

Low-EMA

|

||||

Nifty

(Future)

|

7874.45

|

7805.10

|

7840.10

|

7657.26

|

7818.52

|

7888.03

|

7725.43

|

||||

BankNifty

(Future)

|

16756.25

|

16590.60

|

16620.80

|

15894.04

|

16483.35

|

16648.24

|

16128.18

|

||||

Weekly Pivot Levels

|

|||||||||||

Security

|

W-S3

|

W-S2

|

W-S1

|

W-Pivot

|

W-R1

|

W-R2

|

W-R3

|

||||

Nifty

(Future)

|

7701.18

|

7770.53

|

7805.32

|

7839.88

|

7874.67

|

7909.23

|

7978.58

|

||||

BankNifty

(Future)

|

16324.58

|

16490.23

|

16555.52

|

16655.88

|

16721.17

|

16821.53

|

16987.18

|

||||

Daily MySAR Levels For Future

Segment :

Daily MySAR Levels For Cash

Segment :

|

|||||||||||

For other Nifty 50 (future) scrips click link :

Do

not enter into a trade without referring past data. It will save your trade

from catching the running train.

If the price of the

scrip ran up or down too much during last few days, please please do not take

fresh entry either of short or long otherwise it will be considered as catching

of running train and in such cases price in near future may move

against expectations resulting into losses. Better wait for breach of MySAR_A

level for fresh trade......

|

|||||||||||

Patience pays...........

Presently holding Position :

---------------------------------------------------------------------------------------------------------------

Anyone want to have complete tradelist of positional trades from 30th June, 2014

please mail us at gauresh59@gmail.com

---------------------------------------------------------------------------------------------------------------

Trades

triggered on 2nd May

1. NF shorted at 7840……………………….covered

at 7822 (+ 18 points)

2. NF long at 7855……………………………booked

at 7867 (+ 12 points)

3. NF short at 7865…………………………..covered

at 7840 (+ 15 points)

4. NF stbt of 29th

April at 7893…………….carried as STBT

Total gain ……………………………..(+

45 points)

1. BNF BTST at

16785…………………booked at 16740 (- 45 points)

2. BNF (2L) shorted at

16685…………covered at 16645 (+ 40 points)

3. BNF short at

16654………………….covered at 16600 (+ 54 points)

5. BNF shorts of

16685………………...covered at 16600 (+ 85 points)

6. BNF long at

16610…………….carried at BTST

Total gain ……………..........……(+ 134

points)

Three Thumb

Rules for intraday trading :

(1) Always trade only at the levels given.

(2) Keep booking profits without missing a winning opportunity.

(3) And once in profit, trail stop loss to the entry level to protect

the capital funds.

Wish you all happy and profitable trading ahead……

==============================================================

Updated upto 2nd May

Following are the trades triggerd as per MySAR levels for Nifty and BankNifty. Calculation of only one lot has been taken into consideration. As per the technique, if Two or more lots are traded and partial profit is booked

in between considering daily as well as weekly pivots and ema numbers,

and go on riding the trend as the levels, then overall profit would

have remained fantastic…. |

|||||||||||

|

|

|||||||||||

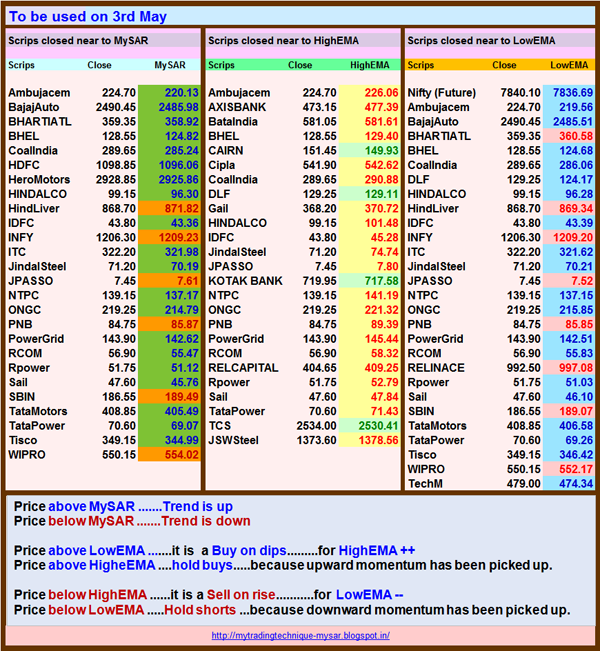

MySAR for 3rd May

Subscribe to:

Comments (Atom)